This decision involves Trading Technologies U.S. Patent Nos. 7,533,056; 7,212,999; and 7,904,374 covering graphical user interfaces for electronic trading.

This decision involves Trading Technologies U.S. Patent Nos. 7,533,056; 7,212,999; and 7,904,374 covering graphical user interfaces for electronic trading.

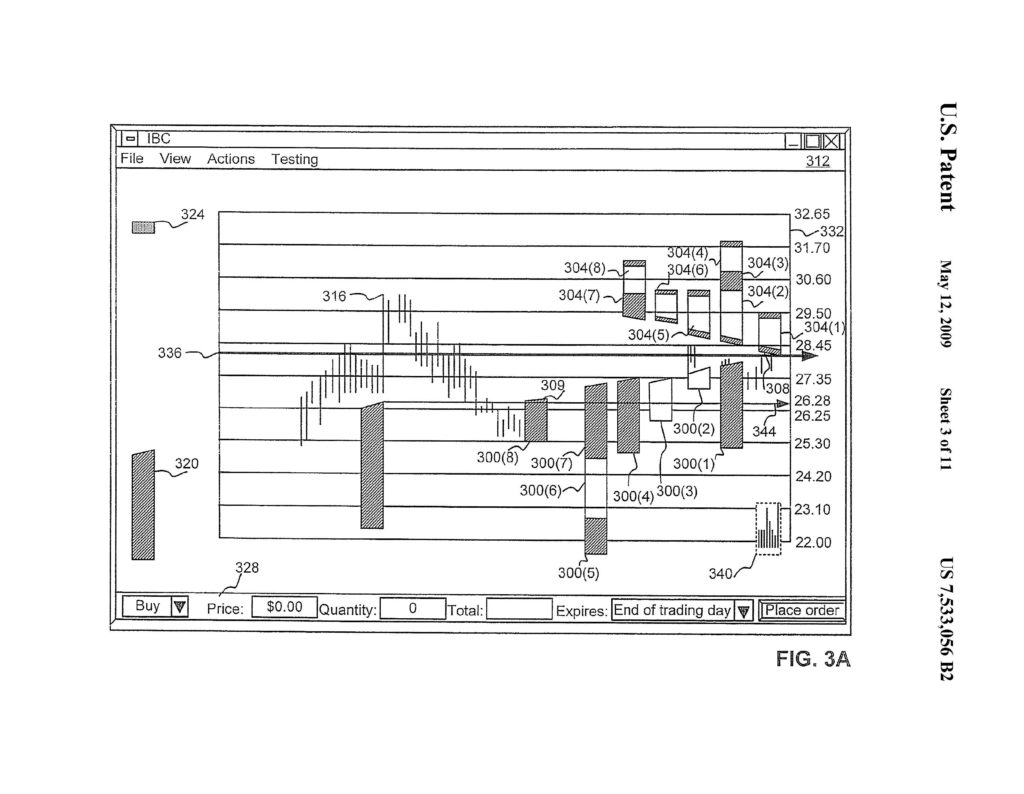

U.S. Patent Nos. 7,533,056 and 7,212,999 disclose a user interface for an electronic trading system that allows a re-mote trader to view trends in the orders for an item, and provides the trading information in an easy to see and interpret graphical format. U.S. Patent No. 7,904,374 discloses a display and trading method to ensure fast and accurate execution of trades by displaying market depth on a vertical or horizontal plane, which fluctuates logically up or down, left or right across the plane as the market prices fluctuate.

Claim 1 of U.S. Patent No. 7,212,999 is representative and recites:

A computer based method for facilitating the placement of an order for an item and for displaying transactional information to a user regarding the buying and selling of items in a system where orders comprise a bid type or an offer type, and an order is generated for a quantity of the item at a specific value, the method comprising:

- displaying a plurality of bid indicators, each corresponding to at least one bid for a quantity of the item, each bid indicator at a location along a first scaled axis of prices corresponding to a price associated with the at least one bid;

- displaying a plurality of offer indicators, each corresponding to at least one offer for a quantity of the item, each offer indicator at a location along the first scaled axis of prices corresponding to a price associated with the at least one offer;

- receiving market information representing a new order to buy a quantity of the item for a specified price, and in response to the received market information, generating a bid indicator that corresponds to the quantity of the item bid for and placing the bid indicator along the first scaled axis of prices corresponding to the specified price of the bid;

- receiving market information representing a new order to sell a quantity of the item for a specified price, and in response to the received market information, generating an offer indicator that corresponds to the Quantity of the item for which the offer is made and placing the offer indicator along the first scaled axis of prices corresponding to the specified price of the offer;

- displaying an order icon associated with an order by the user for a particular quantity of the item;

- selecting the order icon and moving the order icon with a pointer of a user input device to a location associated with a price along the first scaled axis of prices;

- and sending an order associated with the order icon to an electronic trading exchange, wherein the order is of a bid type or an offer type and the order has a plurality of order parameters comprising the particular quantity of the item and the price corresponding to the location at which the order icon was moved.

Claim 1 of U.S. Patent No. 7,533,056 is similar and recites:

A method of operation used by a computer for displaying transactional information and facilitating trading in a system where orders comprise a bid type or an offer type, the method comprising:

- receiving bid and offer information for a product from an electronic exchange, the bid and offer information indicating a plurality of bid orders and a plurality of offer orders for the product;

- displaying a plurality of bid indicators representing quantity associated with the plurality of bid orders, the plurality of bid indicators being displayed at locations cor-responding to prices of the plurality of bid orders along a price axis;

- displaying a plurality of offer indicators representing quantity associated with the plurality of offer orders, the plurality of of-fer indicators being displayed at locations corresponding to prices of the plurality of-fer orders along the price axis;

- receiving a user input indicating a default quantity to be used to determine a quantity for each of a plurality of orders to be placed by the user at one or more price levels;

- receiving a user input indicating a desired price for an order to be placed by the user, the desired price being specified by selection of one of a plurality of locations corresponding to price levels along the price axis; and

- sending the order for the default quantity at the desired price to the electronic exchange.

Claim 1 of U.S. Patent No. 7,904,374 recites:

A method for facilitating trade order entry, the method comprising:

- receiving, by a computing device, market data for a commodity, the market data com-prising a current highest bid price and a current lowest ask price available for the commodity;

- identifying, by the computing device, a plurality of sequential price levels for the commodity based on the market data, where the plurality of sequential price levels includes the current highest bid price and the current lowest ask price;

- displaying, by the computing device, a plurality of graphical locations aligned along an axis, where each graphical location is configured to be selected by a single action of a user input device to send a trade order to the electronic exchange, where a price of the trade order is based on the selected graphical location;

- mapping, by the computing device, the plurality of sequential price levels to the plurality of graphical locations, where each graphical location corresponds to one of the plurality of sequential price levels, where each price level corresponds to at least one of the plurality of graphical locations, and where mapping of the plurality of sequential price levels does not change at a time when at least one of the current highest bid price and the current lowest ask price changes; and

- setting a price and sending the trade order to the electronic exchange in response to receiving by the computing device commands based on user actions consisting of: (1) placing a cursor associated with the user input device over a desired graphical location of the plurality of graphical locations and (2) selecting the desired graphical location through a single action of the user input device

The Federal Circuit agreed with the U.S. Patent and Trademark Office’s Appeals Board that these claims are directed to a covered business method and thus CBM review was appropriate. The Federal Circuit found that they were all eligible for covered business method (CBM) review. In a CBM review, a patent can be attacked under 35 U.S.C. 101 for being non-patent eligible after an analysis in accordance with Alice v CLS Bank. Having found that the claims were eligible for a CBM review, the Federal Circuit then performed an Alice analysis to determine if the software patents for graphical user interfaces were patent-eligible.

The Appeals Board at the U.S. Patent and Trademark Office determined claim 1 is directed to “the abstract idea of graphing (or displaying) bids and offers to assist a trader to make an order.” The Federal Circuit agreed. The claim’s preamble states that it is a “computer based method for facilitating the placement of an order for an item and for displaying transactional information to a user regarding the buying and selling of items.” The method steps require “displaying” a plurality of bid and of-fer indicators along a “scaled axis of prices,” “receiving market information,” displaying that information along the axis, and “displaying” information pertaining to a user’s order. This essentially describes receiving information, which the specification admits was already available to “market makers,” and displaying that information. The Federal Circuit noted that they have treated collecting information, including when limited to particular content (which does not change its character as information), as within the realm of abstract ideas, citing to Electric Power Grp., LLC v. Alstom S.A.

Claim 1 also recites sending an order by “selecting” and “moving” an order icon to a location along the price axis. According to the Federal Circuit, this does not change our determination that the claims are directed to an abstract idea. As the Board determined, placing an order based on displayed market information is a fundamental economic practice. The fact that the claims add a degree of particularity as to how an order is placed in this case does not impact the analysis at Alice step one.

The fact that this is a “computer-based method” does not render the claims non-abstract. The specification indicates the claimed GUI is displayed on any computing device. As a general rule, “the collection, organization, and display of two sets of information on a generic display device is abstract.” Relying principally on Core Wireless Licensing S.A.R.L. v. LG Electronics, Inc., Trading Tech argued the claimed invention provides an improvement in the way a computer operates. The Federal Circuit did not agree. The claims of the ’999 patent do not improve the functioning of the computer, make it operate more efficiently, or solve any technological problem. Instead, they recite a purportedly new arrangement of generic information that assists traders in processing information more quickly. The Federal Circuit concluded that the claims are directed to the abstract idea of graphing bids and offers to assist a trader to make an order.

At step 2 of the Alice analysis, the Federal Circuit is to consider the elements of each claim both individually and ‘as an ordered combination’ to determine whether the additional elements ‘transform the nature of the claim’ into a patent eligible application.” The Board held that the claims do not contain an inventive concept. It determined that receiving market in-formation is simply routine data gathering, and displaying information as indicators along a scaled price axis is well-understood, routine, conventional activity that does not add something significantly more to the abstract idea. It likewise determined that selecting and moving an icon is well-understood, routine, conventional activity. It considered the elements both individually and as an ordered combination and concluded they did not transform the claim into a patent eligible application of the abstract idea. The Federal Circuit agreed.

With regard to U.S. Patent No. 7,533,056, like the ’999 patent, the Board at step one determined claim 1 is directed to “the abstract idea of graphing (or displaying) bids and offers to assist a trader to make an order.” The Federal Circuit agreed.

At step two, the Board held the elements, both individually and as an ordered combination, do not recite an inventive concept. Trading Technologies argued the claims improve computer functionality by improving on the intuitiveness and efficiency of prior GUI tools. The specification makes clear that this invention helps the trader process information more quickly. This is not an improvement to computer functionality. The Federal Circuit saw no merit to Trading Tech’s argument.

Regarding U.S. Patent No. 7,904,374, at step one, the Appeals Board held that claim 1 of the patent is directed to the abstract idea of receiving user input to send a trade order. It explained that claim 1 only minimally requires collecting and analyzing information and includes no requirement that any of that information is displayed. This is because the claims require “displaying . . . graphical locations along an axis” but do not require the graphical locations to display the price levels that are mapped to them. Based on the Board’s understanding, the graphical locations need not provide any information to the user.

This case is unfortunate because a previous, non-precedential, Trading Technologies decision found a patent covering a stock trading graphical user interface to be patent-eligible. That decision gave hope to patent practitioners that software could be patentable if graphical user interfaces were described and claimed. Some commentators argued that many or even all graphical user interfaces should be patentable for reasons similar to those described in that case. Unfortunately, the different judges of the Federal Circuit have different understandings of Alice, leading to the case law being inconsistent. This decision makes clear that the only safe harbor is if there is unique hardware or if the software somehow improves operation of the computer. These claims were fairly narrow but the software limitations were not enough to carry the day.

Trading Technologies argued that because non-precedential decisions of this court held that other Trading Technologies patents were for technological inventions or claimed eligible subject matter, this court should have too. The Federal Circuit declined, stating that they are not bound by non-precedential decisions at all, much less ones to different patents, different specifications, or different claims. Each panel must evaluate the claims presented to it. It is unfortunate that the previous Trading Technologies decision was not precedential but this one was.

Trading Technologies International Inc., v. CQG, Inc., Federal Circuit 2017 (non-precedential) (software patents)

This decision should be very interesting to software developers who want software patents on unique graphical user interfaces. The decision is non-precedential, but can be cited to the U.S. Patent and Trademark Office when the facts in a patent application uniquely match those in this case. Up until this case, and after Alice, the Federal Circuit had consistently found the claims to user interfaces patent-ineligible, reasoning that generically claimed user interfaces that merely present information that had been collected and analyzed are ineligible.

This decision should be very interesting to software developers who want software patents on unique graphical user interfaces. The decision is non-precedential, but can be cited to the U.S. Patent and Trademark Office when the facts in a patent application uniquely match those in this case. Up until this case, and after Alice, the Federal Circuit had consistently found the claims to user interfaces patent-ineligible, reasoning that generically claimed user interfaces that merely present information that had been collected and analyzed are ineligible.

Trading Technologies International, Inc. charged CQG with infringement of U.S. Patent Nos. 6,772,132 and 6,766,304. CQG appealed the decision of the district court that the patents recite patent-eligible subject matter.

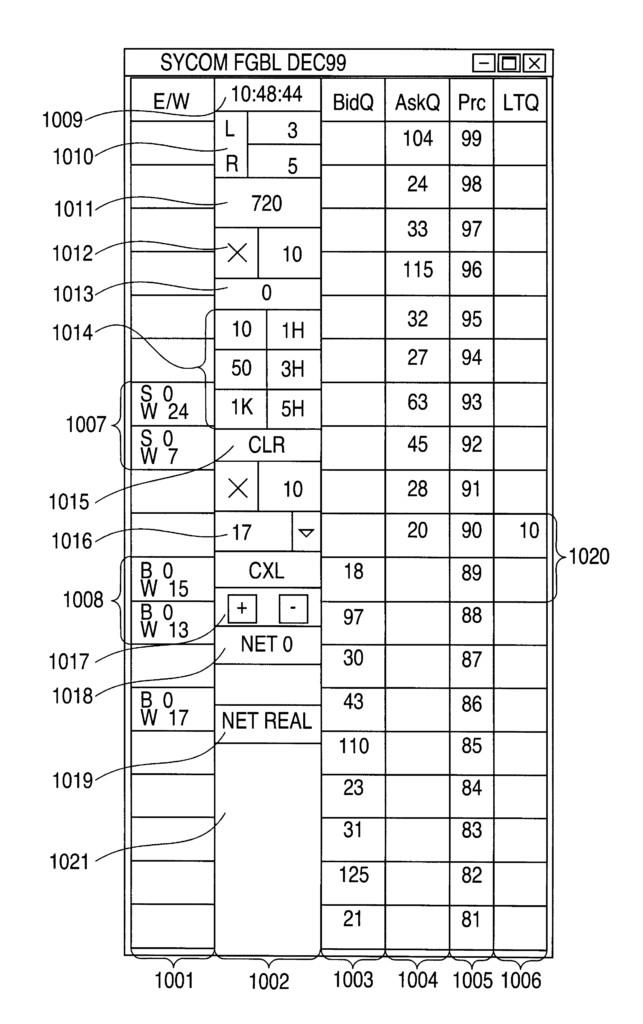

The software patents describe and claim a method and system for the electronic trading of stocks, bonds, futures, options and similar products. The software patents explain problems that arise when a trader attempts to enter an order at a particular price, but misses the price because the market moved before the order was entered and executed. It also sometimes occurred that trades were executed at different prices than intended, due to rapid market movement. The software patents describe a trading system in which a graphical user interface displays the market depth of a commodity traded in a market, including a dynamic display for a plurality of bids and for a plurality of asks in the market for the commodity and a static display of prices corresponding to the plurality of bids and asks. Bid and asked prices are displayed dynamically along the static display, and the system pairs orders with the static display of prices and prevents order entry at a changed price.

Claim 1 of the ‘304 software patent is representative:

1. A method for displaying market information relating to and facilitating trading of a commodity being traded in an electronic exchange having an inside market with a highest bid price and a lowest ask price on a graphical user interface, the method comprising;

- dynamically displaying a first indicator in one of a plurality of locations in a bid display region, each location in the bid display region corresponding to a price level along a common static price axis, the first indicator representing quantity associated with at least one order to buy the commodity at the highest bid price currently available in the market;

- dynamically displaying a second indicator in one of a plurality of locations in an ask display region, each location in the ask display region corresponding to a price level along the common static price axis, the second indicator representing quantity associated with at least one order to sell the commodity at the lowest ask price currently available in the market;

- displaying the bid and ask display regions in relation to fixed price levels positioned along the common static price axis such that when the inside market changes, the price levels along the common static price axis do not move and at least one of the first and second indicators moves in the bid or ask display regions relative to the common static price axis;

- displaying an order entry region comprising a plurality of locations for receiving commands to send trade orders, each location corresponding to a price level along the common static price axis; and

- in response to a selection of a particular location of the order entry region by a single action of a user input device, setting a plurality of parameters for a trade order relating to the commodity and sending the trade order to the electronic exchange.

Alice Corporation Pty. Ltd. v. CLS Bank International, provides the framework for patent-eligibility of business methods and software patents. A software patent’s claim falls outside § 101 where (1) it is “directed to” a patent-ineligible concept, i.e., a law of nature, natural phenomenon, or abstract idea, and (2), if so, the particular elements of the claim, considered “both individually and ‘as an ordered combination,’” do not add enough to “‘transform the nature of the claim’ into a patent-eligible application.”

The district court first applied Step 1 of this framework. The district court held that, rather than reciting a mathematical algorithm, a fundamental economic or longstanding commercial practice, or a challenge in business, the challenged software patents solve problems of prior graphical user interface devices . . . in the context of computerized trading relating to speed, accuracy and usability.

The district court found that these patents are directed to improvements in existing graphical user interface devices that have no “pre-electronic trading analog,” and recite more than “‘setting, displaying, and selecting’ data or information that is visible on the [graphical user interface] device.” Id.

The district court explained that the challenged patents do not simply claim displaying information on a graphical user interface. The claims require a specific, structured graphical user interface paired with a prescribed functionality directly related to the graphical user interface’s structure that is addressed to and resolves a specifically identified problem in the prior state of the art. The district court concluded that the patented subject matter meets the eligibility standards of Alice Step 1.

The Federal Circuit agreed with this conclusion, for all of the reasons articulated by the district court.

The district court alternatively continued the analysis under Alice Step 2, and determined that the challenged claims recite an “inventive concept.”

The court identified the static price index as an inventive concept that allows traders to more efficiently and accurately place trades using this electronic trading system. The court distinguished this system from the routine or conventional use of computers or the Internet, and concluded that the specific structure and concordant functionality of the graphical user interface are removed from abstract ideas, as compared to conventional computer implementations of known procedures. Thus the district court held that the criteria of Alice Step 2 were also met.

The Federal Circuit stated that the district court’s rulings are in accord with precedent for software patents. Precedent has recognized that specific technologic modifications to solve a problem or improve the functioning of a known system generally produce patent-eligible subject matter. In DDR Holdings, LLC v. Hotels.com, the Federal Circuit upheld the patent eligibility of software patent claims necessarily rooted in computer technology that overcome a problem specifically arising in the realm of computer networks. Similarly, claimed processes using a combined order of specific rules” that improved on existing technological processes were deemed patent-eligible in McRO, Inc. v. Bandai Namco Games America Inc.. Claims that were directed to a specific improvement to the way computers operate, embodied in a self-referential table, were deemed eligible in Enfish, LLC v. Microsoft Corp. These software patent cases are described below in this blog.

The Federal Circuit pointed out that, for some computer-implemented methods, software may be essential to conduct the contemplated improvements, as indicated by Enfish. “Much of the advancement made in computer technology consists of improvements to software that, by their very nature, may not be defined by particular physical features but rather by logical structures and processes.”). Abstraction is avoided or overcome when a proposed new application or computer-implemented function is not simply the generalized use of a computer as a tool to conduct a known or obvious process, but instead is an improvement to the capability of the system as a whole.

The Federal Circuit reiterated the Court’s recognition that “at some level, all inventions . . . embody, use, reflect, rest upon, or apply laws of nature, natural phenomena, or abstract ideas.” per Alice. This threshold level of eligibility is often usefully explored by way of the substantive statutory criteria of patentability, for an invention that is new, useful and unobvious is more readily distinguished from the generalized knowledge that characterizes ineligible subject matter. This analysis is facilitated by the Court’s guidance in Alice whereby the claims are viewed in accordance with “the general rule that patent claims ‘must be considered as a whole’.”

This decision should be considered when attempting to patent software that includes a graphical user interface.